Oceanfront Property Prices: What You Need to Know

When you hear Oceanfront property prices, the cost of buying or renting a home that sits directly on the sea edge, including land value, construction, and extra fees. Also known as coastal property rates, they vary widely based on view, exposure, and local demand. A nearby Beachfront property, a home that sits on the sand but may not face the open water often sets a price baseline, while a Coastal home, any residence within a few miles of the shoreline adds its own market dynamics. Understanding the broader real estate market, the system of buying, selling, and valuing property in a region is essential before you start crunching numbers.

Key Factors Shaping Oceanfront Property Prices

Location is the biggest driver. A property with an unobstructed 180‑degree sea view commands a premium, while a spot tucked behind cliffs may be cheaper but still cost more than inland homes. Weather exposure matters too; areas prone to flooding or erosion often see higher insurance premiums, which feed directly into the overall price. Oceanfront property prices also reflect construction choices – a sturdy concrete build with salt‑resistant materials costs more upfront but can lower long‑term maintenance. Speaking of upkeep, salt spray accelerates wear on roofs, windows, and paint, so owners budget extra for regular repairs. Finally, rental potential adds a financial layer: popular tourist spots let owners offset costs by renting out the house seasonally, which can make a higher purchase price worthwhile.

Insurance is a separate line item that can't be ignored. Policies for sea‑facing homes usually cover wind, wave damage, and flood, and they can be 20‑30 % higher than standard home insurance. The exact figure depends on the property's elevation, proximity to protective dunes, and local climate trends. Many buyers also invest in flood defenses or elevated foundations, which raise the upfront cost but may reduce insurance rates over time. Understanding these trade‑offs helps you see how insurance influences oceanfront property prices and informs smarter budgeting.

Maintenance costs are another hidden expense. Salt is corrosive, so metal fittings, HVAC units, and even concrete need regular inspection. A typical annual maintenance budget ranges from £2,000 to £5,000 for a modest sea‑front cottage, and it climbs quickly for larger estates with pools or private beaches. Homeowners often set aside a reserve fund equal to 1‑2 % of the property's value each year to cover unexpected repairs. This practice ensures the sea‑view stays pristine and protects the investment's resale value.

Market trends play a big role, too. In recent years, demand for oceanfront homes has surged as remote work allows people to live farther from city centers. This shift pushes prices upward, especially in regions with limited coastline. Conversely, economic downturns can temporarily soften demand, creating buying opportunities for savvy investors. Tracking the real estate market's supply‑and‑demand cycles gives you a clearer picture of when oceanfront property prices might dip or peak.

Finally, compare beachfront and oceanfront properties to avoid confusion. Beachfront homes sit on the sand but may have a limited sea view, while oceanfront homes overlook the water directly, often from cliffs or raised foundations. Oceanfront locations typically carry higher insurance and maintenance costs, but they also command stronger rental yields and resale appeal. Knowing the distinction helps you weigh the pros and cons of each option and understand how each influences overall price.

Below you’ll find a curated set of articles that break down these topics in detail, from cost breakdowns and budgeting tips to real‑world case studies of oceanfront purchases. Dive in to get the numbers, the advice, and the confidence you need to tackle oceanfront property prices head‑on.

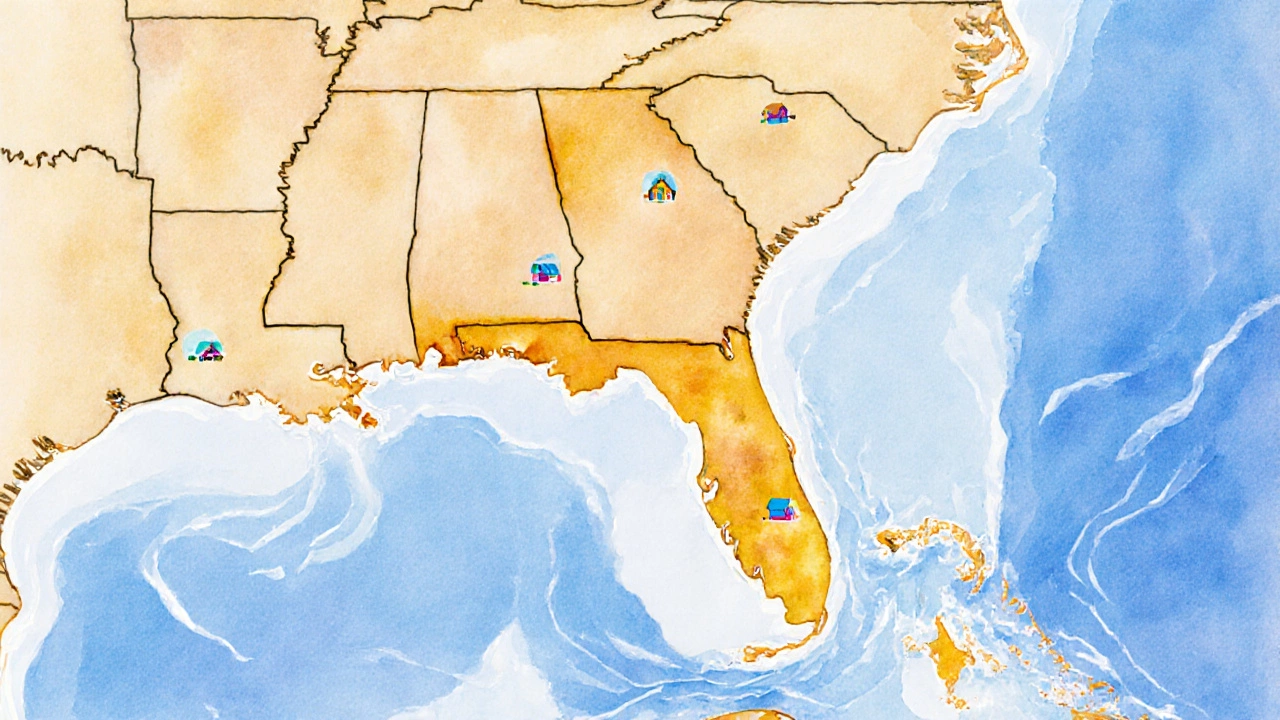

Which US State Has the Cheapest Oceanfront Property in 2025?

Find out which US state offers the lowest-priced oceanfront homes in 2025, with data, hidden costs, and buying tips for budget‑savvy buyers.