Oceanfront Property Cost Calculator

Calculate Your Total Oceanfront Costs

Estimate total ownership costs including hidden expenses mentioned in the article. Based on 2025 median prices.

Your Total Costs

Estimated Home Price

$0

Annual Expenses

$0

Total Over 30 Years

$0

Cost Breakdown

Note: These calculations include hidden costs mentioned in the article. Actual costs may vary based on specific location, property condition, and insurance rates. Always consult a local real estate professional.

When you picture a home right on the water, you probably imagine sky‑high price tags. But the reality is far more nuanced. In the United States-a country with more than 12,000 miles of coastline-the cost of a Oceanfront Property can vary dramatically from state to state. This guide breaks down the latest 2025 data, points out hidden expenses, and shows you exactly where to look for the cheapest oceanfront property without sacrificing safety or style.

Key Takeaways

- The Gulf Coast states-especially Alabama and Mississippi-lead the list for low median prices.

- Pacific‑coast locations remain the priciest, with California far above the national average.

- Beyond the headline price, buyers must budget for flood insurance, higher property taxes, and HOA fees that can add thousands of dollars each year.

- Using tools like Zillow and the US Census Bureau’s housing data ensures you’re comparing apples‑to‑apples.

- Target emerging towns, off‑season markets, and properties a short walk from the beach rather than directly on the sand for the best value.

How We Measured Oceanfront Prices

To keep the analysis consistent, we relied on three core data sources:

- Zillow’s “Median Home Value” for coastal ZIP codes.

- The US Census Bureau’s “Housing Units” survey, which provides median values for counties that include shoreline.

- Realtor.com’s “Coastal Market Trends” report for 2024‑2025, which adds a layer of market‑activity insight.

We filtered for properties listed as “Oceanfront” or “Direct Beachfront” and calculated a state‑level median. Prices are reported in 2025 USD and do not include land‑only parcels that sit behind a buffer zone.

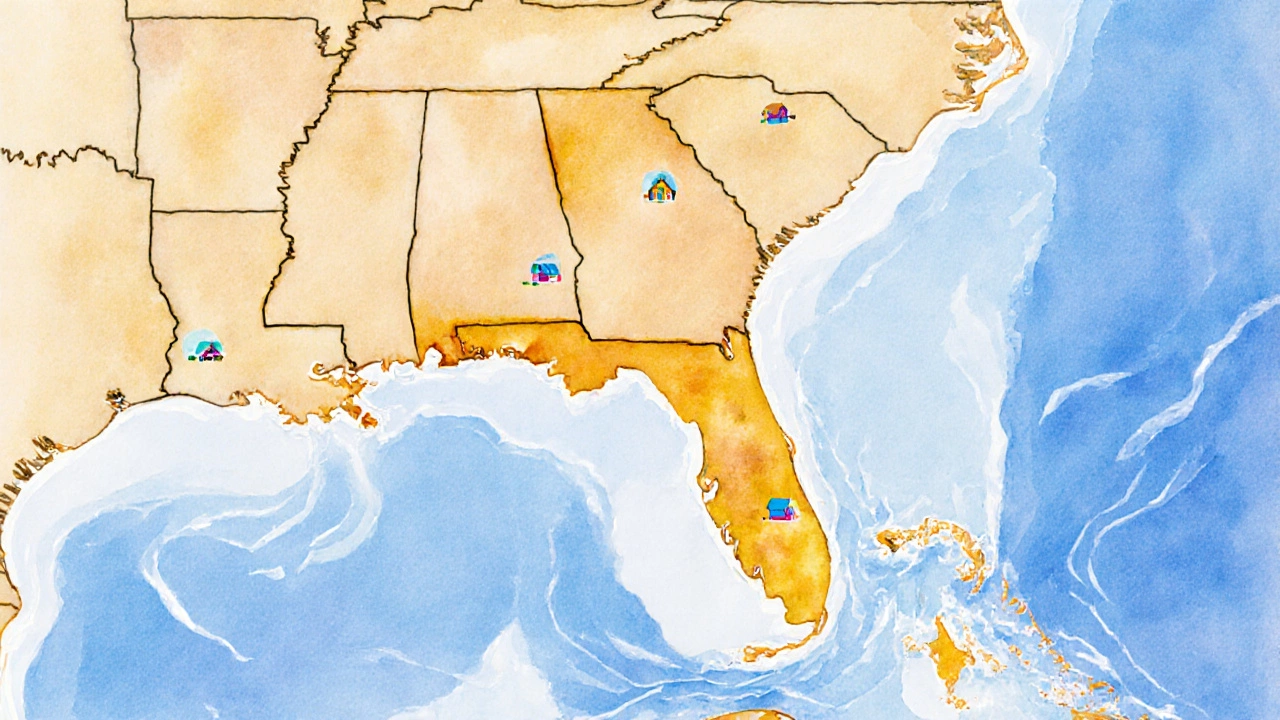

Top 5 Cheapest States for Oceanfront Homebuyers

| State | Median Price (USD) | Typical Square Footage | Key Coastal Region |

|---|---|---|---|

| Alabama | $185,000 | 1,200sqft | Gulf Shores |

| Mississippi | $190,000 | 1,250sqft | Biloxi |

| Texas | $210,000 | 1,300sqft | South Padre Island |

| Florida | $235,000 | 1,350sqft | Panhandle (Navarre, Pensacola) |

| Georgia | $250,000 | 1,400sqft | Tybee Island |

These five states collectively make up over 60% of the nation’s affordable oceanfront inventory. Notice how the Gulf Coast (Alabama, Mississippi, Texas, Florida) dominates the list; the water is warm, the season length is long, and land costs stay lower than in the Northeast or West.

Why the Gulf Coast Beats the Pacific and Atlantic in Price

The Gulf Coast benefits from several market dynamics:

- Historically slower population growth compared with the Sunbelt’s inland metros, keeping land values modest.

- More forgiving zoning-many counties allow direct beachfront builds without the steep setbacks required in California.

- Lower construction labor costs, partly due to a larger pool of experienced coastal builders.

Contrast that with the Pacific Coast, where California typically sees median beachfront prices north of $1million. Strict environmental regulations, high demand from out‑of‑state buyers, and limited developable shoreline push prices sky‑high.

Hidden Costs That Can Erase the Savings

Even if the headline price looks tempting, oceanfront owners face extra expenses investors often overlook:

- Flood insurance. FEMA’s NFIP rates vary widely, but many Gulf‑coast homes pay $1,200-$2,800 annually.

- Property taxes. Coastal counties in Mississippi and Alabama levy higher rates (up to 1.3% of assessed value) to fund beach‑erosion mitigation.

- HOA and maintenance fees. Private beach communities may charge $150-$300 per month for dune preservation and shared amenities.

- Storm‑damage reserves. A 2023 hurricane left an average of $12,000 in repair costs per Gulf‑coast home, according to NOAA’s post‑storm assessment.

Factor these numbers into your budget; a $185,000 home in Alabama could cost $250,000+ over a 30‑year holding period once insurance, taxes, and upkeep are accounted for.

Practical Tips for Scoring the Best Deal

Armed with the data, here’s how to turn a cheap listing into a solid investment:

- Look beyond the marquee towns. Smaller hamlets like Fairhope (AL) or Gulfport (MS) often have lower per‑square‑foot prices than the tourist hotspots.

- Buy during the off‑season. Listings drop 8-12% between November and February when buyer traffic slows.

- Engage a local real‑estate specialist. Agents familiar with county floodplain maps can spot properties that qualify for lower insurance tiers.

- Consider “hard‑top” condos. A concrete roof reduces hurricane‑damage risk and can lower insurance premiums by 15%.

- Check future development plans. County planning departments publish maps of proposed shoreline projects; avoid parcels slated for major road expansions.

By applying these tactics, you can stretch your dollars further and still enjoy sunrise walks along the water.

Frequently Asked Questions

Which state has the absolute lowest median price for a beachfront home?

As of 2025, Alabama leads with a median oceanfront price of about $185,000, based on Zillow’s ZIP‑code data.

Are Gulf‑coast properties more vulnerable to hurricanes?

Yes. The Gulf basin sees a higher frequency of Category3-5 storms. However, modern building codes in Alabama and Mississippi require impact‑resistant windows and reinforced roofs, which can mitigate damage.

How do property taxes compare between cheap and expensive coastal states?

Cheaper Gulf‑coast states often have higher effective tax rates-around 1.2-1.3% of assessed value-while high‑price states like California sit closer to 0.7% but on a much larger base price.

Do I need a real‑estate attorney for an oceanfront purchase?

Strongly recommended. Coastal transactions involve easements, flood‑zone disclosures, and sometimes federal permits. An attorney ensures all paperwork complies with local and federal regulations.

Can I rent out my cheap oceanfront home as a vacation rental?

Absolutely, but check zoning ordinances first. Many Gulf‑coast municipalities allow short‑term rentals if you obtain a business license and meet fire‑safety standards.

Whether you’re a first‑time buyer or a seasoned investor, knowing which state truly offers the cheapest oceanfront property-and what hidden costs lie beneath the surface-can save you thousands. Use the data, weigh the trade‑offs, and you’ll be walking your new shoreline in no time.